Overnight, I received my Google Wave invite. So far, no one I know has a Wave account, I’ve sent out a few invites and hopefully later today, I can begin riding the Wave. More soon…

Home Tech

I purchased and installed Mozy Home on my MacBook Pro in addition to the iMac at home. One thing different for the initial backup this time around is my upstream connection. I’m currently using an outside connection from work which a screaming fast upstream and I can tell you, Mozy is cruising along much better this go round. I started at about 9am this morning and my backup has completed almost 20% of 30GB. Not bad, not bad.

Surprisingly, though, I had much better performance at home on the upstream, also, over the weekend. Although not nearly as fast as at work, my home connection and the Mozy client was preparing and streaming content constantly without the interruptions in between as new data was prepared. It seemed to be a fluid process this go around, so I’m not sure what may have changed in the software or in the backend to have improved the process, but it was greatly improved.

So, just another quick update. The incremental updates from Mozy at home when I have added new photos to the iPhoto library and other incremental changes have been very smooth and quick to pick up. There is a lot of light at the end of the tunnel once your initial backup completes.

Yes, you read that correctly. USAA Federal Savings Bank will soon be allowing many of its customers to deposit checks into their accounts using the iPhone and its camera, according to an article published in the New York Times. For at least a year, the same bank has been allowing their customers, like myself, to deposit checks using a scanner to image the check – front and back – and deposit it online, instantly. Its a service they brand as ‘Deposit @ Home’. That process has proved very successful for USAA and highly effective by my determination. It is the only way that my wife and I deposit checks now.

But it begs the question, why do this? To answer that, you have to understand that USAA is not your standard bank. USAA caters mostly to military families and their dependants. Its members are widespread and not concentrated in any one area (except maybe military bases). It also has members all around the globe. USAA doesn’t have physical branches. Everything is done over the phone or via the internet.

Yeah, seems like today is a day of #fail for me. I realize today scanning over my blog content that I’ve all but abandoned my new buddy Moneywell. Its very close to a month since I used it last and although I really like the software, its different and I’m having troubles with that. I am still finding myself relying on Microsoft Money and its darned running balances. Habit is hard to break.

Now, a month later, I have a lot of reconciliation to do to catch up in Moneywell. The thing I am struggling with most in the software are duplicate transactions and how to easily find them. Running balance is how I’ve always been able to check and make sure everything is on track from day to day, and although the daily totals are in Moneywell, I’m finding it hard to find errors.

And, part of this is self-inflicted (see, really sensing a theme here). I like to prepopulate my transactions in my financial program and so there are transactions for up to a month in advance in Moneywell. So when the real transaction downloads and the dollar amounts don’t match from my guestimate transaction, my balances go wonky.

The other thing I miss from Microsoft Money is my bill reminders – my recurring transactions in Quickbooks speak. I’ve used these to remind me of annual and quarterly bills, plus my monthly transactions. Its kept me honest with the trash company and even helped me make sure I never overdraw the account on a month-to-month basis.

So, back to the drawing board. I need to carve out some time this week in the evening to get things caught up in Moneywell. I really believe the software has a lot of promise for me and for my family’s finances. I need to give it an honest try!

Quicken has again pushed back its release date for Quicken Financial Life for Mac, now anticipating its release in February of 2010 . This is about the third time that Quicken has pushed back the release of this new software. It was originally debuted (in much the same form as today) back in January, 2008, at MacWorld and was heralded as a top-to-bottom rewrite utilizing modern Mac development frameworks.

For those in the beta test program, it doesn’t come as much of a surprise. Quicken Financial Life shows a lot of promise, but many of the features are yet to be implemented. The release was supposed to come during the summer months of 2009, but any reference to that release have since been hidden on the Intuit website. Pages of information previewing the release have been removed and the Quicken Blog post is the only source for any current information.

My personal frustration over this release is apparently shared by many users, judging by the comments left on the blog post. I wonder why it taking so much time to show any real progress in the product. QIF import, for instance, isn’t implemented making transferring your historical data next to impossible. The only way to import historical data is upgrading from Quicken for Mac 2007 – which I don’t own. Capturing what’s left of the switchers, like myself, is a big way that Intuit could capitalize and profit with this release, but it seems to be ignored. Oh, well, time will tell.

Following up on my earlier post about Chrome OS, I got to thinking. Google has GMail for email, Talk for chat, Google Docs for word processing, spreadsheets and presentations, and a slew of other cloud based apps. But what is missing from their portfolio and therefore missing in Chrome OS? I know we don’t know most of the details yet, but we can imagine that the system (being simple and secure) would have very little in it – maybe Chrome browser and maybe a GTalk client.

1) Music – we’re a world accustomed to iTunes and buying our music online. Where will that fit? How will it — or simply will Chrome OS handle media files?

2) Video – Sure, like music, what about video playback? YouTube is great, but there aren’t any video editing tools online as part of YouTube – you have to somehow capture and piece together your videos. I’ve never encountered an online video editing software (yet…).

3) Gaming – Sure EA is making some of their games available online and it is generally accepted for game consoles to have online portals to download games – but how will Chrome OS accomplish this? Will it shy away from this on its underpowered hardware ?

4) Photo editing – Sure, Google has Picasa, but will it be packaged with Chrome OS? It has Picasaweb, but its features are currently very limited and its space is also.

What else am I missing – I’m sure there is more…

Making the statement that all you need to run today is now online, Google has introduced it own OS – dubbed Chrome OS and largely based around its Chrome web browser. Its a bold statement where thick-clients are still the de-facto standard. But it comes at a time where online applications like GMail and Google Docs are gaining ground on their bulkier, arguably-obese first-cousins.

It is a natural extension of the cloud platform that Google has been developing for years, and an evolutionary step for Google. Until the introduction of Chrome, the browser, Google was largely at the mercy of third-party browser developers. And while it shocked many that Google introduced their own browser, it made sense to control the main interface to their products and to be able to control that experience. Apple has used the same, successful model in their business controlling the end to end of their user experience and its garned them a lot of success.

I’ve been silent for the last week and enjoying my newest toy – the iPhone 3.0 upgrade which dropped last week. I’m very impressed with the release and with the incremental steps that Apple has delivered to all of us customers. In the meantime, I’ve been one-up’d at work by many co-workers who have upgraded to the iPhone 3Gs handsets with video, improved cameras, and more speed (yes, just a wee bit jealous).

I am really enjoying many of the improvements in 3.0, including landscape mode for several applications – including mail and messages. A blogger I follow tweeted this article from CNet which details how to enable tethering on the iPhone… Draw your own conclusions as to its legality, but its one of the features I want most on the iPhone and AT&T is not allowing it at this time.

I’m also enjoying push notifications as of today for Beejive IM – an excellent pay-for IM client for all your different accounts. I installed that app this morning and I’ve had it running at work. Noteworthy features include Facebook chat, a really smooth chat switching method when you’re having mutliple conversations, and push notifications, of course. The service/software keeps you signed into your accounts even after disconnecting and will forward any received messages or statuses to your phone via a push notification which displays on your home screen. This is Apple’s work-around to background processes on the phone, which, they say, kills battery life.

iPhone 3.0 also grants the ability to subscribe to CalDAV calendars and integrate those. I have a friend who needs this setup, so I should be trying that soon. I use MobileMe, personally, for my family and our calendars and it works great – but to give enterprise customers who have invested in OS X Server the ability to leverage iCal Server is a great feature, in my opinion.

And speaking of my MobileMe subscription, a new feature has been added there – Find my iPhone – a locator service and the ability to display a message on-screen and have the phone play a tone. For those of us who lose things, its a nice feature when you’re looking for your phone while its stuck in the couch. At least one person has already used the service to successfully reclaim a stolen iPhone… That story is a very good read.

I know that I should be switching from Money and making Moneywell my primary finance software, but I’m having a tough time. I can’t seem to ensure that my checkbook balances to the accounts and that procedure is harder for someone who is so tied to online banking, like myself. Let me explain.

I’ve covered before how Moneywell handles running balances and accounts. Something that I haven’t mentioned is that Moneywell has some really good, powerful reconciliation workflows integrated in it. The Reconcile screens are great for someone who is paper based and who reconciles the checkbook with the printed statements at the end of the month. But, that’s not me – those aren’t my habits. And it has to be a system that works with me, else I have to change and the chances of success decrease.

The reconcile functionality appears to be their solution for keeping your checkbook in balance. For that type of system, I’m sure that it works well and the daily balances make much more sense — see, you’ll have a statement balance to match to every month in that style system.

But, what about someone who uses online banking – particularly someone who does it daily and whose reconciliation process occurs almost as often? I guess that I could begin matching the running balance online with the daily balance in Moneywell and marking the transactions as reconciled once they hit the online account and clear. That, I assume, is the same net outcome as reconciling to a paper statement. So, that is what I am resolving today to attempt for the next week. I’m going to try and modify my actions and see if I may be able to adopt a better way of accounting my personal finances.

In the meantime, I have been relying too heavily upon Microsoft Money. I know this and I have paid money for a software which seems to be better long term. I have to keep this in my mind and remind myself daily to do it.

So, changing platforms is never easy. I experienced my share of hurdles moving from Windows to Mac OS . There were times when I said “why can’t it just do __”, but mostly I was happy with my platform change. Over time, I’ve found so many great Mac-only solutions that when I’m at work, I’m wishing I had __ on my PC.

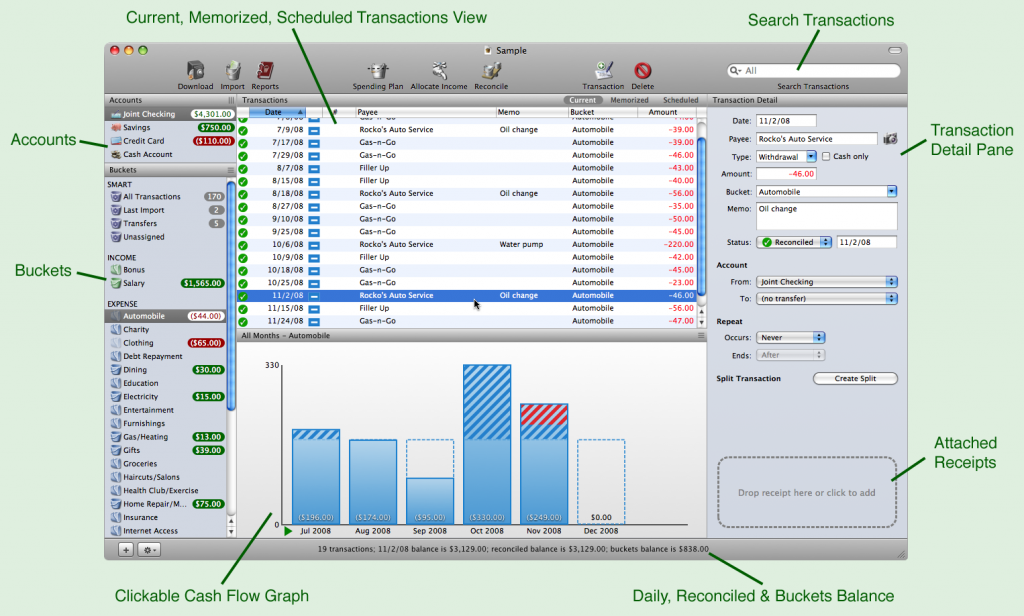

But right now, I’m at the why doesn’t my new product live up to my old product point and its over running balances. See, in the Moneywell there aren’t any running totals. See this screenshot below (from the Moneywell website):

Much of what I like about Moneywell is that they’ve re-thought traditional personal finance software. But, I used running balances to play what if and make sure I don’t overdraw my accounts by posting upcoming transactions. I know it seems archaeic but that is how I found best NOT to get into trouble. Money’s cash flow forecaster was never accurate for me, so I couldn’t rely on it. I went the more low-tech way and just added transactions and saw what was left.

So, I mentioned the Moneywell is a re-think product and in the case of balance, it rethinks that too. If you click on a transaction, in the bottom bar, it shows a daily balance amount for the day of the transaction. That is great, but its not graphical or easy to see at glace to the “single window” interface. There is also no “red flag” you’re in trouble indicator for a day, that I’ve found.

So, I’m searching for Moneywell’s better way. I’m sure its here, but just in case – a cash forecast graph would be a great feature in the next release. Take that daily balance and graph it… I haven’t figured out how to read the bar charts at the bottom of the page (nor change them) so maybe that’s what they’re intended for, but if so, its not intuitive and its also not day by day…